Tata Technologies IPO: A Strong Start Followed by Underperformance

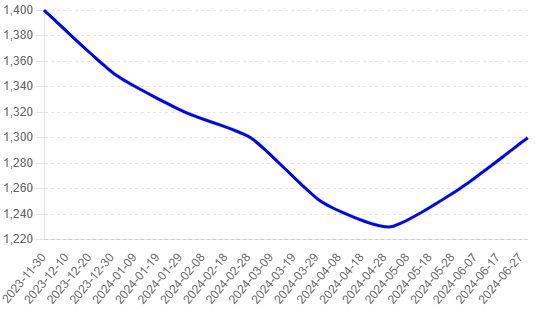

Tata Technologies, which had the most profitable IPO last year, was listed on the bourses on November 30, 2023. The listing premium was an impressive 180% compared to the IPO price band of Rs 475-500. Despite this strong debut, the stock has since underperformed, failing to surpass its listing day high. Analysts have cited several factors, including the Tata group parentage, the company’s global business model, and its growth potential in the engineering R&D services market, as drivers for the initial strong investor demand and premium valuation. However, the stock has been struggling recently, and brokerages have started downgrading it due to its premium valuation and other concerns.

Strong IPO Debut

- IPO Pricing and Listing Premium: Tata Technologies’ IPO was priced in the range of Rs 475-500. The stock opened at a 160% premium and reached a high of Rs 1,400, marking a 180% increase.

- Current Valuation: The stock is currently trading at around Rs 1,300, which, although significantly higher than the IPO price, is below its listing day high.

Initial Success Factors

- Tata Group Parentage: Affiliation with the reputable Tata Group boosted investor confidence.

- Global Business Model: Tata Technologies’ extensive global operations and potential in the engineering R&D services market attracted strong investor demand.

Reasons Behind Underperformance

The main reasons for Tata Tech’s stock price underperformance in 2024 include a drop in quarterly net profit and overall market conditions. Tata Tech’s Q4 net profit fell by 28%, leading to reduced investor confidence. Additionally, the stock has declined about 8% year-to-date, partly due to broader market volatility and profit booking following its strong IPO debut in late 2023. Despite these challenges, the company has potential for recovery, supported by strategic ventures such as its joint venture with BMW Group.

- Premium Valuation: The stock is trading at over 70 times earnings, raising concerns about overvaluation.

- Analyst Downgrades: Several brokerages have downgraded the stock, citing high valuation and other concerns.

- Revenue Concentration: Heavy reliance on key clients like Tata Motors and Jaguar Land Rover may pose a risk if these clients reduce their spending or switch vendors.

- Competitive Industry: The engineering R&D services market is highly competitive, requiring continuous innovation and strategic positioning.

- Operating Margins and Profitability: Maintaining margins and profitability in a competitive industry is challenging.

- Foreign Exchange Risks and Taxation Complexities: Managing these aspects is crucial for sustained performance.

- Innovation Investment: Investing in innovation to stay ahead of technological changes is essential for long-term growth.

Key Factors to Monitor

- Revenue Diversification: Expanding beyond key clients is crucial to mitigate risks associated with revenue concentration.

- Winning New Clients and Orders: Success in acquiring new clients and orders in the rapidly growing engineering R&D services market will be a key growth driver.

- Maintaining Margins and Profitability: Ensuring strong operating margins and profitability is vital in a competitive landscape.

- Managing Foreign Exchange Risks and Taxation: Effective management of these factors is essential for stable performance.

- Investing in Innovation: Continuous investment in innovation is necessary to stay ahead of technological advancements.

Mixed Analyst Views and Forecasted Stock Price

Analysts have mixed views on the stock at current levels. Some believe it remains attractively valued compared to peers, while others feel the current price exceeds the company’s fundamentals. Based on current analyses, forecasted stock prices for Tata Technologies vary:

- Bullish Forecasts: Optimistic analysts forecast the stock price could reach up to Rs 1,600 in the next 12 months, driven by potential new client acquisitions and market expansion.

- Bearish Forecasts: More cautious analysts predict the stock could decline to around Rs 900, citing concerns over high valuation and competitive pressures.

Conclusion

While Tata Technologies made a strong debut, its recent underperformance highlights the importance of careful evaluation. Monitoring key factors and understanding the risks associated with premium valuation and revenue concentration will be crucial for investors considering this stock. The mixed analyst forecasts underscore the need for a nuanced approach, weighing both the growth potential and the inherent risks.